GIVE BACK. GET INVOLVED. TAKE ACTION

More than a grant maker, we believe that bringing together Individuals and Companies who give through United Way TT on a regular basis, is what makes us unique – we are a means to take to scale the smallest of contributions through pooling of funds entrusted to us and by signalling other funders and individuals.

Connect with us: unitedway@uwtt.com or call (868)-717-8630 to find out more.

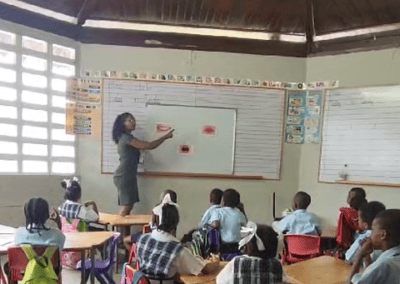

Your generous contributions enables us to continue assisting our schools, students, teachers, families and communities throughout Trinidad and Tobago. Click on the gallery below to see some of the projects your donations helped to impact throughout the country in 2022/23!

UWTT in partnership with Music Literacy Trust (MLT) launched a two-week vacation camp for over 30 students, 5-8 years of age from St. Mary’s Mucurapo Boys and Girls R.C. Primary Schools. This project, which falls under the Building Bridges from Learning to Success Programme, Out of School Time component.

UWTT was able to install Hopscotch Boxes at 3 schools: Mucurapo Boys R.C., Patna River Estate Government, and St. David’s R.C. Primary Schools. These fell under the Out of School Time Component of the Building Bridges programme.

NDOC 2023 saw 48 Projects Completed with 10 Collective Working Partnerships and 1,730 #CareAmbassadors. SERVING❤️ 27 Primary & Secondary Schools, 16 Homes for Children & the Elderly and 5 Communities REACHING 🙌 13,588 Beneficiaries across Trinidad & Tobago

Family Cash grants were used to purchase groceries and essential supplies. They were also used to pay utility bills such as electricity and internet.

NOW Teacher Training Group saw 25 trainees including those from 4 new schools added to the programme.

UWTT & NOW! partner for Foundations for Reading and Language Development in the Building Bridges Programme across 15 schools, serving over 300 students.

DONATE

Direct Deposit

First Citizens

Account #: 1367844

Account Type: Chequing

Name: United Way of

Trinidad & Tobago

RBC Royal Bank

Account #: 100088110396955

Account Type: Savings

Name: The United Way of Trinidad & Tobago

republic bank

Account #: 180473293901

Account Type: Chequing

Name: The United Way of Trinidad & Tobago

ScotiaBank

Account #: 74815000170637

Account Type: Chequing

Name: The United Way of Trinidad & Tobago

Bill Payee

Follow the easy instructions in the link below to set up United Way Trinidad and Tobago as a Bill Payee at CIBC, First Citizens, JMMB, Republic Bank, RBC Royal Bank, or Scotiabank.

PAY THROUGH EMPLoYER

If your company is on our list of Supporters, you can donate to us via payroll deduction.

Contact your HR department with your request and fill out the following details so we can follow up

INTRODUCING UNITED WAY TRINIDAD & TOBAGO

Noor Hassanali Society for Civic Leaders

With the blessing of our Patron, Mrs. Zalyhar Hassanali, we are proud to introduce the United Way Trinidad & Tobago Noor Hassanali Society for Civic Leaders.

Noor Hassanali was a deeply revered patriot and a founding figure in the history of United Way Trinidad and Tobago, working over several years to ensure we got off the ground successfully. He was a quiet, constant and generous philanthropist who unassumingly led in personal Civic Giving.

This society seeks to connect Corporate to Civic Leadership Giving, reconciling the undeniable bond between how we give and its impact on the rights and lives of all of our citizens.

The society will recognize the philanthropic leadership giving of those who continuously and generously to the common cause of caring in Trinidad and Tobago.

To find out more and about how you can give email us at unitedway@uwtt.com.

donations to uwtt are eligible for tax refunds

Did you know that UWTT has Charitable Status and that donations to UWTT are eligible for a tax deduction by means of a Deed of Covenant?

Deeds of Covenant, of up to 15% of your total income in any one year, is allowable as a deduction against your income for tax purposes. This means that you could get 25% of your gift to UWTT as a tax refund, if you have not exceeded the 15% limit. The Deed of Covenant must be registered with the Ministry of Finance – Inland Revenue Division, before December 31st of the year you give your donation. The refund is claimed when submitting your tax return.

Read more information about Deed of Covenants from the Ministry of Finance – Inland Revenue Division website.

Multi-Year Deed of Covenant

You can do multi-year deeds. If you plan to give/donate the same amount for more than one year, you can indicate that on your deed. The benefit of this is that you will not have to file a deed each year.

Filling out the Deed of Covenant

It is a simple process in which the UWTT staff is willing to assist. The Form and more details on the process can be downloaded from here. Contact us for more information.